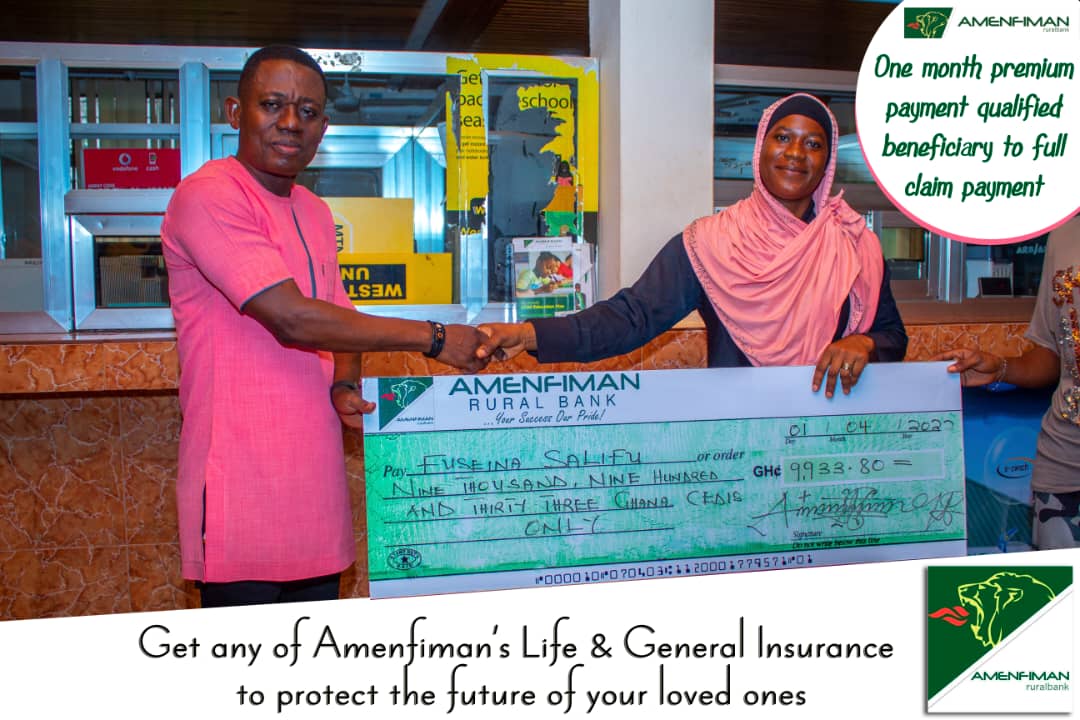

Presenting the cheque to the next of Kin – Fuseina Salifu, Mr. Anthony Adu-Broni who is the Head of Human Resource and Administration of the Bank indicated that Mr. Mustapha Salifu did a Home Call Insurance Policy with Amenfiman Rural Bank and contributed just one month with an amount of GHC 47.00 and died through an accident. Ordinarily, such an insurance has a waiting period of 91 days before a claim can be enforced but because the policy holder died through an accident the bank had no option than to pay the Benefit.

The Next of Kin – Fuesana Salifu who received the Claim Benefit was very appreciative to Amenfiman Rural Bank for fulfilling their word. According to her, she thought such insurance policies are not real but after receiving the Death Benefit from the Bank she is convinced that Amenfiman Rural Bank is really a trusted partner. Fuseina Salifu requested the general public to look no where for their Life Insurance Policies rather than Amenfiman Rural Bank.

Call Amenfiman Rural Bank now for your Home Call Plan Policy, Child Education Plan Policy and Wealth Master Plan Policy to secure your future financial needs.

Amenfiman Rural bank, Your success Our Pride!